How can you prepare against calamities?

- VSK Team

- Aug 18, 2015

- 5 min read

Updated: Mar 21, 2024

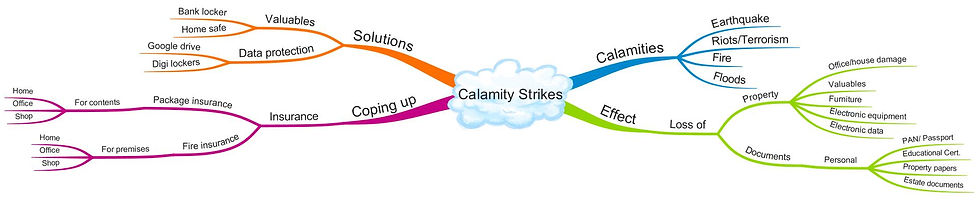

In our recent article, we talked about ‘How to prepare financially for Emergencies’. In our latest post, we are going to talk about protection from calamities. While people seek protection for their life and health, it usually doesn’t occur to them that their belongings need protection too.

Last month there was a fire in one of the units in our office building. It started off with a spark in the air conditioner but quickly spread and in the process gutted the whole office. This gave rise to a whole host of problems for the owner like:

Monetary loss (mitigated if covered by fire insurance)

Loss of documents and computer network (again insurable)

Loss of data (unless saved and stored in a different location or on the cloud).

Additional issues like renting out another office for a short period which hopefully is near to the existing office.

Now imagine, instead of office, this kind of incident occurs in a residential house – your costliest asset. And it is exposed not just to the threat of fire. Your house and its contents face the risk of burglary. It can get destroyed by floods, earthquake, etc. Don’t you think most of the above challenges would remain? So how do you ensure its safety?

There are various types of covers available in the market which protects your house & belongings from unforeseen incidents and calamites. Let us examine these options:

Fire Insurance: A fire insurance policy offers protection against any loss/damage/destruction of property arising out of fire. The different types of property covered under a fire insurance policy are residential house, office, shops, etc. and their contents. The policy also covers fire arising out of any lightning, explosion, riot, strike, storm, cyclone, hurricane, floods, etc. However, it does not cover loss or damage caused by war & warlike operations, nuclear perils, burglary & housebreaking, etc. Certain calamities like earthquake are covered with the payment of additional premium. Consequent losses such as start-up expenses, rent paid for alternate accommodation can also be covered through additional premium. The policy pays for depreciated value or replacement value of the items destroyed depending upon the type of policy and coverage bought.

Burglary Insurance: A burglary insurance cover offers protection against theft in residential house, office, shops, etc. Besides offering cover for the contents in the insured premises, the policy pays loss/damage caused to any property caused during burglary. The policy pays for the actual loss/damage caused to the property due to theft/housebreaking subject to the limit of the sum insured.

Home insurance policy: This is a comprehensive policy which provides security to your house/office and its contents against unforeseen calamities. These not only provide protection from fire, burglary but also from earthquakes, floods, terror strikes, riots, hurricane, cyclone, etc. There are certain policies which provide multiple covers and you have the option to choose from them at an additional premium. These insurance covers come at an unbelievably cheap cost but are largely ignored in India. For e.g. a 1,500 square feet house can be covered against fire and other perils for Rs.50 lakhs at a mere cost of Rs.2,100 per year.

Protecting your important documents from disasters

Proper insurance coverage can compensate you for the financial loss that you suffer during calamities. But it cannot retrieve your important documents which are destroyed forever. So how do you safeguard them?

Firstly, it is important to make a list of all your important documents. These include educational certifications, bank documents including KYC & home loan agreement, house property documents including share certificate, insurance policies including mediclaim card, identity proofs like PAN Card, Aadhar Card, Voting Card, Driver’s License, etc., investment documents like demat statements, mutual fund statements, etc.

Now let us examine the options of storing these documents:

Digi-Locker: This is one of the safest options to protect your documents in the event of any calamity. The Government of India recently launched Digital Locker, a facility aimed at eliminating the usage of physical documents and enable sharing of e-documents across government agencies via a mechanism to verify authenticity of the documents online. Resident Indians can also upload their own electronic documents and digitally sign them using the e-sign facility. This facility can store documents like Voter Id, Pan Card, BPL Card, Driving License, education certificates, etc. This cloud system ensures digital safety of data & the documents are considered as authorised. So even if your physical documents are lost during any calamity, you will have digital back-up. Even if you have to make physical copies again for any documents in any exceptional case, the digital data will act as a proof and make your job easier. Here is the link for further details – https://digitallocker.gov.in/

Google Drive: This is one of the most popular systems to store your personal data. It is safe and comes with 5 GB of free storage which is sufficient enough to store your personal documents. The best part is that you can sync it with all your other devices like mobile, tablet, etc., and access your documents from anywhere in the case of emergencies.

Protecting your valuables from burglary & fire:

Bank Lockers: These are a good option for storing your valuables. It comes with a cost ranging from Rs.1,000-Rs.5,000 depending upon the size of the locker. Banks however cannot be held responsible for the contents in the locker in the event of a burglary or fire. They can be held liable though if adequate security has not been provided to the lockers or they are not maintained properly. Nonetheless, this traditional way of storing valuables in bank lockers remains a safe bet. Banks have to follow stringent guidelines of safety as per RBI rules. They have to use the best quality lockers which undergo rigorous safety tests and are fire-resistant. Nowadays, it is not that easy to get a bank locker. We will cover this topic of hassles in renting a bank locker in detail in our next article.

Home Safe: While we usually entrust our valuables to bank vaults, what about the precious stuff that we use regularly? The banks have an annual limit on the number of visits for taking out valuables from lockers and it is a hassle to frequent the banks for taking out precious stuff used on a regular basis. To safeguard your treasures of regular usage (like gold chains, earrings, diamond jewellery, etc.) home safe is a good option. These are a better option than your traditional almirahs and cupboards which can easily be burgled or can get destroyed by fire. There are safes available in the markets which are certified to guarantee their strength and endurance. A home safe costs between Rs.3,000-Rs.60,000 depending upon their size and strength. There are various types of safes available in the market such as electronic safes, fire-resistant safes, fire and burglary resistant safes, etc.

To conclude, people realise the importance of insurance until a casualty hits them hard. Buying just life and health insurance is not enough though. Risk management should involve buying comprehensive covers which protect your property and its contents against disasters/calamities at an unbelievably lower cost. Having digital back-ups for documents and lockers for valuables can also help mitigate losses to a great extent. Being prepared does not cost a bomb and help to comfortably tide over tough times.

Comments