How prepared are you financially for any Emergency?

- VSK Team

- Aug 5, 2015

- 5 min read

Updated: Mar 21, 2024

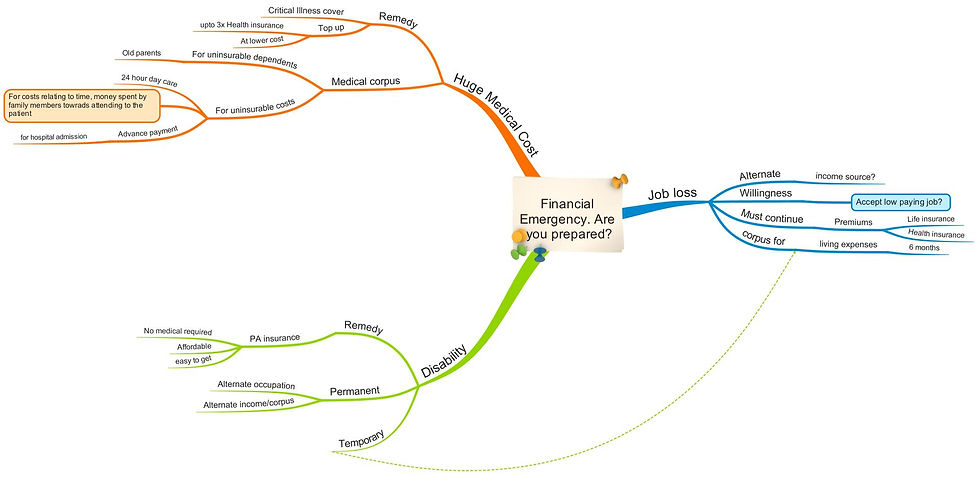

Life sometimes can deal a cruel blow to you and if not prepared, it can hit you hard. While many people buy insurance for protection, it does not go beyond life and health insurance for majority. But there are certain situations which can catch you off guard and later may prove to be a big drain on your financial resources. Let us examine them one by one.

(1) Loss of job: A couple with high paying jobs was working in a prominent healthcare company in the research department. The company one fine day decided to permanently shut the research wing. It was a big blow to the double income earning couple. Luckily, the husband was absorbed in another department by the company. The wife remained jobless for about six months and was at home. Recently in 2015, TCS, one of the largest software companies in India laid off thousands of employees. And not just the juniors, even middle and senior level managers who were working for over 5-7 years and earning fat packages. This can happen to anyone. It could take longer, even over a year, to get a new job, particularly in the recessionary period. Assume you lose your job today, then –

How many months living expenses can you afford to bear without a regular salary stream? (Living expenses here include – household expenses, EMIs, insurance premiums, children’s school/college fees, SIPs in mutual funds, etc.)

Have you maintained an emergency fund?

Can you compromise on your lifestyle and spending habits?

Do you have an alternate source of income when your steady job is lost?

Can you afford to continue your life insurance and health insurance policies?

Are you ready to compromise on low pay in a new job for temporary period?

These are crucial questions you would have to address were you to lose your job. So how prepared are you if such an eventuality strikes you?

(2) Exorbitant Medical Costs: Any medical emergency of a family member/relative can dent a big hole in your pocket, especially if the illness is chronic. One of our clients ran a hospital bill of Rs.17 lakh for his mother who was admitted in a heart institute for 2 months! His mother had a medical cover for Rs.5 lakhs and the balance Rs.12 lakh was paid by my client from his pocket. He was compelled to sell most of his mutual fund and stock investments. Let us examine a few options which can help prepare for sudden & huge medical expenses:

(I) Top-up Insurance Cover: With health care costs shooting through the roof, a medical cover of about Rs.2-3 lakhs (usually the average sum assured bought) is not adequate enough for a serious ailment or a chronic illness. To cover any shortfall, top-up insurance covers are a good affordable option. These are regular indemnity plans which cover hospitalisation costs but only after a regular threshold is crossed. This threshold is known as deductible, the portion of money which the insured has to pay before the policy comes into effect. For e.g., you have a basic health insurance plan of Rs.3 lakh and a top-up insurance of Rs.8 lakh with a deductible of Rs.3 lakh. Suppose you run a hospital bill of Rs.10 lakh, Rs.3 lakh will be covered by your base plan and Rs.7 lakh can be paid from your top-up plan. The premium paid on a top-up cover would be much cheaper as compared to the premium paid on a regular Rs.10 lakh health insurance policy.

(II) Critical Illness Cover: Critical illness covers bought in addition to the basic health cover are of great help during inflationary times. If there is a case of medical history in the family like heart attack, cancer, etc., it makes sense to buy a critical illness policy. These policies give you a tax-free one time lump sum payment if you or your loved ones are diagnosed with a serious medical condition specified in the policy.

(III)Emergency Funds: Last but not the least, emergency funds are a big help to tide over sudden medical situations. No matter how adequately insured you are, you would always require hard cash during health emergencies. It could be:

(A) For uninsurable costs: There are certain expenses which do not come under the ambit of health insurance cover. For e.g., medical costs of certain equipment like ball usage in hip replacement surgery, hearing aids, external prosthetic devices like artificial limbs, 24 hour day care at home, etc. Emergency funds would act as a safety net to prepare for such uninsurable costs.

(B) For advance payment: At the time of admitting in a hospital, one has to usually deposit large amount of cash even if the person has medical insurance. Emergency funds can be of great help to tide over temporary cash crunch.

(C) For uninsured dependants: What if your elder parents do not have any health insurance cover when the require the most in old age? A medical corpus is a must especially if an elder parent has a serious medical history involved. Maintaining an emergency fund of about Rs.5-10 lakhs could thus be of great help during any hospitalisation of the elderly.

(3) Disability: News of accidents are strewed over newspapers daily nowadays. Pick any newspaper and you will inevitably find at least one case of accident reported. Accidents cause not just death, but disability too. Disability could be temporary or permanent. It could physically impede you to earn potential income. Your earnings would not grow further but your household expenses and EMIs would be there to pay. While you may recover from temporary disability or any illness, it is not possible to recover from permanent disability. It stays for a lifetime. And, may bring along the routine of incurring regular medical expenses. You would need to address certain crucial questions in the event of physical incapacitation:

Do you have any personal accident insurance?

What if you are not in a position to work even from home after disability?

Do you have any alternate source of income to bear your living expenses?

Your health insurance would only pay for hospital bills but not cover for disability which may incapacitate you (temporary or permanently) to earn income. Personal accident insurance would go a long way in helping you cope with additional medical expenses in the case of accidental disability. These policies come unbelievably cheap but are the most ignored due to lack of awareness. These are easy to get and do not required any medical tests. The sum assured is paid depending upon the type of injury and the injury covered.

While your biggest financial asset remains your capability to earn money, it is better to be prepared and plan certain pertinent steps to sail through tough times. It is prudent to involve your family members in your entire planning otherwise it can go futile in your absence. A word of advice – Do not just read this article, take a notepad right now with you, make points and then assess where you are lacking.

Comentários